New Year, New Campaign

Golden Leaves International continues to drive forward with the launch of their new ad campaign for 2018. The ads will follow on from last year and continue to be personalised and more specific to each service the team offer. You will be able to see videos from each regional agent including new members of the GL team and a big presence online via social media along with radio adverts. The growth of this excellent campaign allows you to get to know the team and more importantly, your local advisor.

The personalised ads, along with monthly columns will be appearing in Spain’s number one English Newspaper, the Euroweekly, and you will also be able to hear the company on Bay Radio, including interviews with the GL team.

We, ourselves as Expats understand how daunting and complicated things can seem overseas especially with the language barrier and that is why we are your helping hand in making the process as easy as possible.

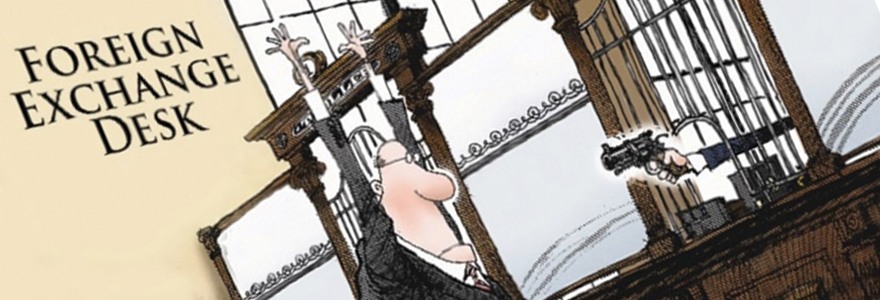

Golden Leaves are your one-stop shop for Pre-Paid Funeral Plans, Health, Car, Home, Travel, Pet and Marine Insurances, Wills, Inheritance Tax & Legal Services, NIE & Residencia Assistance and Foreign Exchange. One call does it all!

Please contact Emma on 966 493 082 for free advice or email info@goldenleavesinternational.com

Keeping you informed

Keeping you informed